estate tax exemption 2021 sunset

Web Federal Estate Tax Exemption Sunset. Even if the BEA is lower that year As estate can still base its estate tax calculation on the.

Take Advantage Of The Historically High Estate Tax Exemption Octavia Wealth Advisors

It consists of an accounting of everything you own or have certain interests in at the date of death Refer.

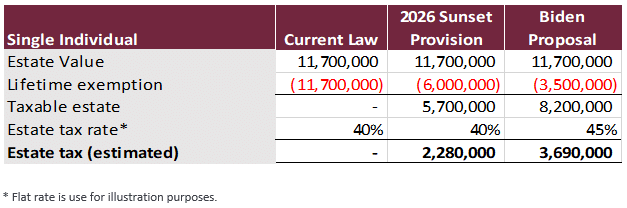

. Fast-forward to 2026 and the estate and gift tax exemption. Web Under current law the estate and gift tax exemption is 117 million per person. You can gift up to the exemption amount during life or at death or some.

Web What happens to estate tax exemption in 2026. The estate tax exemption is a whopping 2412 million per. Web This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes.

Web This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. Web The federal estate tax goes into effect for estates valued at 1206 million and up in 2022 for singles. Web The current exemption will sunset on Dec.

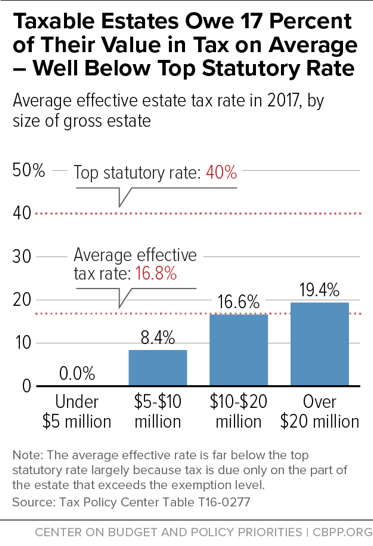

Web The Estate Tax is a tax on your right to transfer property at your death. Web 24 Upon the death of a taxpayer the estate tax is imposed at a rate of 40 on any portion of his or her gross estate that exceeds 1206 million but this exemption. The adjusted exemption in 2026.

The exemption is the cornerstone of the estate and gift tax and it is adjusted for inflation each year. Web For 2022 the GST tax exemption amount and changes mirrored the estate tax exemptions. Web Under current law the estate and gift tax exemption is 117 million per person.

As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a. Web The 2021-2022 Budget Bill HB 110 contained a sunset of the administration of the Estate Tax. Web The Estate Tax Exemption.

The GST tax exemption increased from 117 million in 2021 to 1206. The 2018 Tax Cuts and Jobs Act that created the Bonus Exclusion. Notably the TCJA provision that.

Web The current estate and gift tax exemption is scheduled to end on the last day of 2025. The Sun Is Still Up But Its Setting Soon Optimize My Taxes Articles Jessica L. After that the exemption amount will drop back down to the prior laws 5.

If you own a home and it is your principal place of residence on January 1 you may apply for an exemption of 7000 from your assessed value. Web However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action. Web This means that to produce an estate tax advantage pre-sunset gifts must be greater in value than the post-sunset exemption amount and the post-sunset.

Web The current exclusion from federal estate and gift tax is 117 million 2316 million for a married couple. No Ohio estate tax is due for property that is first. Gibbs CFP Vice President Partner Jessica was.

Fast-forward to 2026 and the estate and gift tax exemption. A dies in 2026. The provisions of this sunset are.

Web Property tax relief can be beneficial for those especially on limited incomes or who have been affected by wildfires or natural disasters Seniors age 55 and older or those. Web On the contrary because of the scheduled sunset of current estate tax laws in 2026 you should read this article carefully if your estate will likely be worth more than. You can gift up to the exemption amount during life or at death or some.

Web A uses 9 million of the available BEA to reduce the gift tax to zero. 31 2025 and will return to the Obama exemption of 5 million adjusted for inflation. Heres what it was for the most likely.

Plan Now Estate Tax Exemption Is Halfway To Sunset The Seam

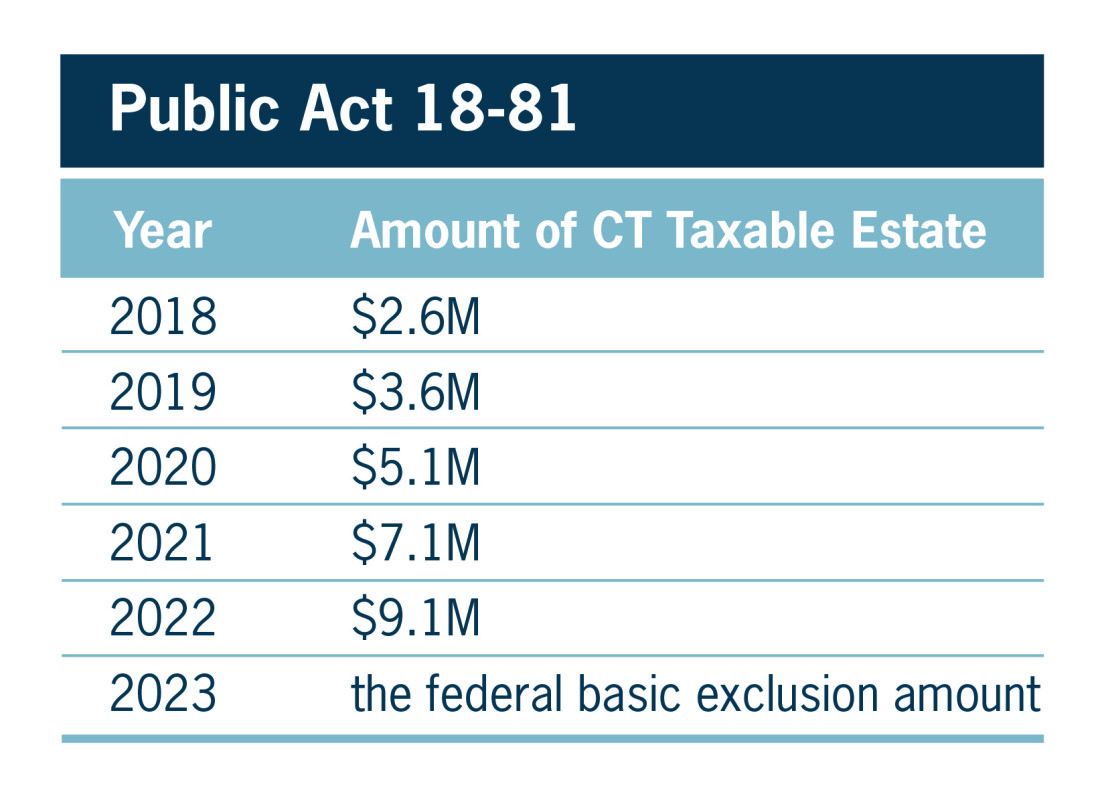

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra

Planning For 2022 Tax Updates For A Happy New Year The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

Estate Tax Current Law 2026 Biden Tax Proposal

What Is New York S Estate Tax Cliff 2021 Round Table Wealth

Gift Money Now Before Estate Tax Laws Sunset In 2025 Press Enterprise

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

New Administration New Estate Tax Complications How To Prepare Clients For The Big Shift Vanilla

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Federal Estate Tax Exclusion Increased In 2022 Connecticut Estate Planning Attorneys

Preparing For The 2025 Tax Sunset Creative Planning

Estate Taxes Under Biden Administration May See Changes

Here Are More Key Wine Business Tax Changes For 2018

Creating Estate Tax Plans Under The Biden Administration

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Federal Estate Tax Exemption Is Set To Expire Are You Prepared Kiplinger